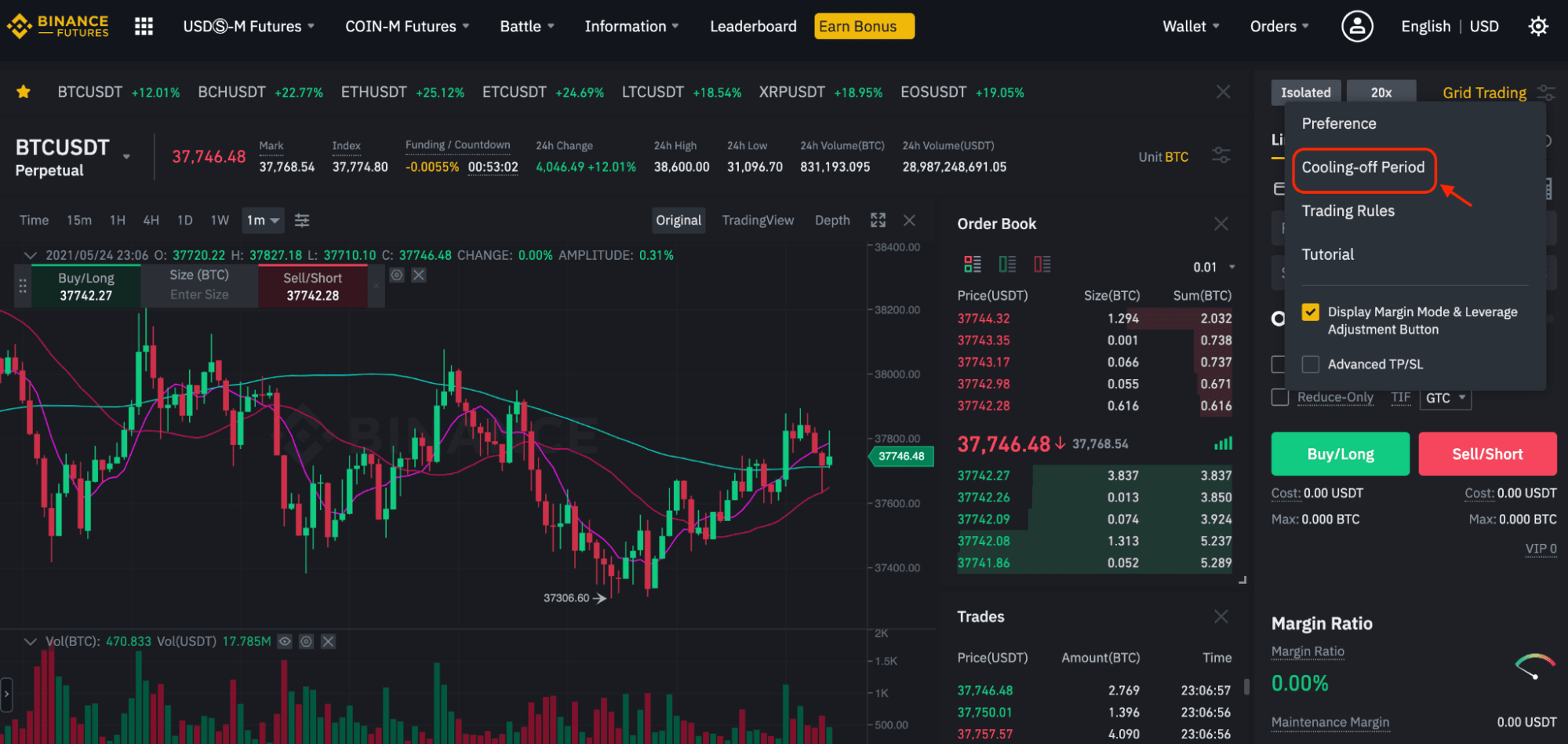

Binance Boss Flees, Investors Panic

Binance, the world’s largest cryptocurrency exchange & Investing platform, saw $956 million in net outflows in the 24 hours succeeding the release that CEO Changpeng Zhao had stepped down from his role to achieve a US probe into the company’s conformity with anti-money sewing regulations.

The outflows, which were first announced by Reuters, represent a significant blow to Binance, which has been struggling to manage its dominance in the cryptocurrency market. The company has been facing growing analysis from manager around the world, and Zhao’s departure is likely to further erode investor assurance.

Binance has been under investigation by the US Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) for its alleged loss to comply with anti-money laundering (AML) regulations. The DOJ has reportedly been considering illegitimate charges against the company, while the SEC is investigating whether Binance committed in insider trading.

Zhao’s departure is seen as an bid to alleviate manager and avoid criminal charges. However, it debris to be seen whether this will be suitable to save Binance from further analysis.

The discharge from Binance come at a time when the cryptocurrency market is already facing a number of objection. The price of Bitcoin, the world’s largest cryptocurrency, has collapsed by more than 70% from its all-time high, and many other cryptocurrencies have also lost value.

The cryptocurrency market is also facing growing meeting from traditional financial institutions, which are developing their own digital currencies. This competition is likely to put further strain on Binance and other cryptocurrency exchanges.

The discharge from Binance are a sign of the growing ambiguity in the cryptocurrency market. Investors are increasingly concerned about the administrative risks identical with cryptocurrencies, and they are pulling their money out of exchanges in search of safer investments.

It remains to be seen whether Binance will be able to weather the disturbance. The company has a strong track record of innovation, and it is achievable that it will be able to acclimate to the changing market conditions. However, the company will need to address the concerns of regulators and investors if it wants to bear in the long term.